Between January and June, China’s battery-electric vehicle (BEV) market saw domestic competition increase. Meanwhile, the plug-in hybrid (PHEV) sector remained closely contested. Autovista24 special content editor Phil Curry examines the country’s electric vehicle (EV) market with EV Volumes data.

China’s BEV market growth faltered again in June, as it caught up with a strong period of sales in 2024. Overall, 3,498,460 units were delivered in the country during the first half of 2025, a 43.7% year-on-year increase.

However, having peaked at a 50.7% rise in the cumulative figures in April, both May and June saw this figure wane. After exceptional growth in February, March and April, improvements were more relaxed in May. June saw an improvement of 39% compared to last year, as 687,277 units were sold in the country.

Meanwhile, the PHEV market returned to an upward growth trend following a wobble in May. The market increased by 36.1% between January and June, with 2,460,588 units taking to Chinese roads.

This was helped by another strong month in June, although the 30.4% monthly increase was the market’s lowest figure since January. Still, the consistent improvements in both BEV and PHEV markets show China’s increasing EV strength.

Geely increases its lead

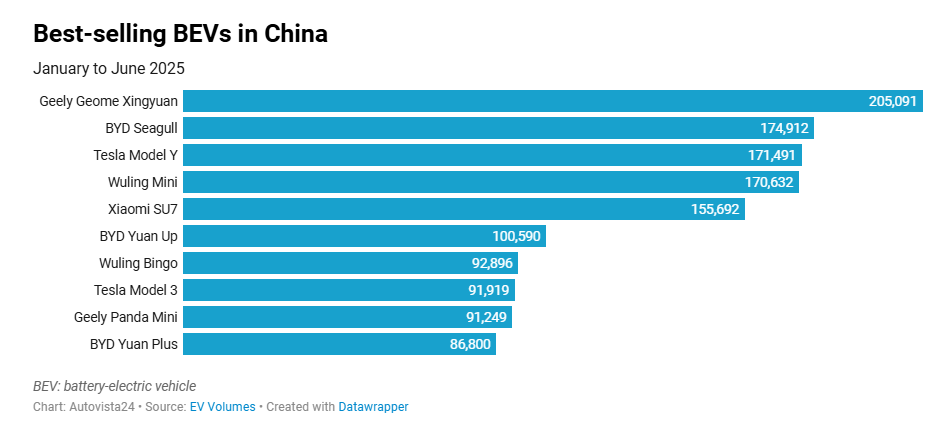

Having reclaimed the top spot in May, the Geely Geome Xingyuan increased its lead in the first half of 2025. The model, which came to the market in September 2024, achieved 205,091 sales between January and June. This meant it made up 5.9% of BEV sales in the country.

June’s outcome created multiple changes in the overall results for the first half of 2025. The BYD Seagull rose to second position, taking a 5% market share with 174,912 units delivered.

This placed it 30,179 behind the Geely model, which has outsold the BYD in five of the six months counted. If the Xingyuan continues its impressive run, it could be difficult to catch.

Tesla’s quarterly delivery boost meant its June results propelled the Model Y into third, from fifth in May. With 171,491 sales, it sits just 3,421 units behind the BYD, taking a 4.9% hold of the market.

The Wuling Mini, which topped the table four months into 2025, slipped back to fourth at the end of June. With 170,632 units delivered, it was just 859 sales behind the Tesla Model Y.

Given the US crossover’s patchy performance in the market in the first half of 2025, the Mini could move up. However, it will need extremely strong results to return to the top of the table.

The fortunes of the BYD, Tesla and Wuling vehicles show the competitive nature of the Chinese market this year. In the first half of 2024, the Tesla Model Y was 50,000 units ahead of the BYD Seagull. This embodied what was a two-horse race 12 months ago. In 2025, the market is more open, with multiple models in the running for the title.

Close competition in China

Fifth went to the Xiaomi SU7 with 155,692 sales. With a 4.5% market share, the model was 14,940 units away from the top four. A further 55,102 units back in sixth was the BYD Yuan Up. It claimed 100,590 deliveries and a 2.9% share of the BEV market in the first six months.

The Wuling Bingo held seventh, with 92,896 units sold and a 2.7% market share. Improving one position to eighth was the Tesla Model 3, benefiting from the brand’s quarterly reporting. It was just 977 units behind the city car, with 91,919 deliveries in total. This gave the BEV a 2.6% market share.

In ninth, the Geely Panda Mini was 670 units behind, having achieved 91,249 deliveries in the first half of 2025. It secured a 2.6% share of the BEV total.

Rounding out the table in 10th was the BYD Yuan Plus, with 86,800 deliveries. Having placed third in the first half of last year, the model has been a victim of increased competition.

Tesla takes the wheel in China

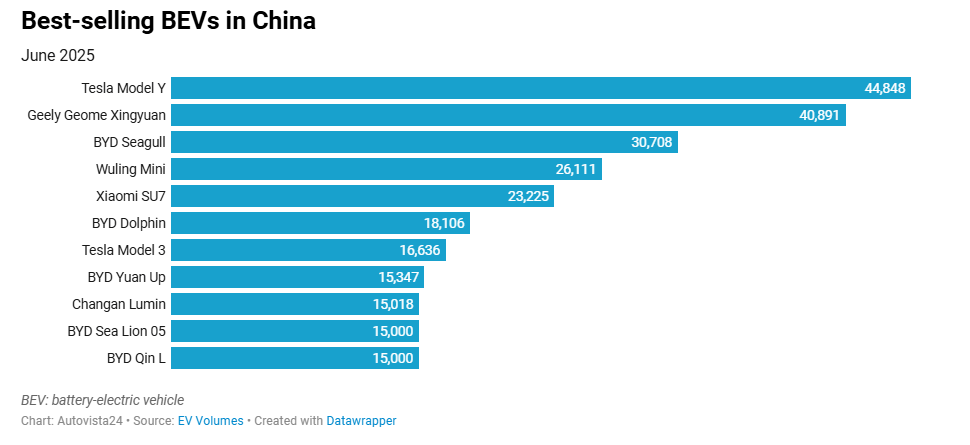

The Tesla Model Y was the best-selling BEV in China during June, thanks partially to the carmaker’s quarterly reporting pattern. It achieved 44,848 deliveries, up 1.7% compared to the same month last year.

This was the model’s best improvement of the year, and only its second across the first six months of 2025. Due to increased competition, its market share fell 2.4 percentage points (pp), to 6.5% in the month.

The Geely Geome Xingyuan continued its impressive performance, with 40,891 deliveries putting it in second. This equated to a 5.9% share of overall deliveries in its 10th month on sale.

The BYD Seagull ended June in third, with 30,708 units taking to Chinese roads. With competition increasing, this was a 12.8% dip compared to last year, while its share of 4.5% was 2.6pp down.

Having struggled in May, the Wuling Mini ended June in fourth and lost further ground to the leading BEV models. It achieved 26,111 deliveries, which was still a 156.3% rise year on year. This also allowed the BEV to grow its market share by 1.7pp, to 3.8%.

Completing the top five was the Xiaomi SU7, with 23,225 units. This was a 62.5% volume increase. It secured a 3.4% hold of the BEV total in the month, up from 2.9%.

BYD on the up

The BYD Dolphin rose to sixth in June with 18,106 deliveries. This was a 114.8% year-on-year improvement, giving the Chinese model a 2.6% market share, up 0.9pp.

Seventh went to the Tesla Model 3, benefiting from the brand’s quarterly reporting. With 16,636 sales, it was 8.3% down on the total achieved in June 2024. This meant its share of the overall BEV total slid from 3.7% to 2.4%.

The BYD Yuan Up took eighth position with 15,347 deliveries, an 82.9% rise. This gave it a 2.2% market share, growing by 0.5pp. In ninth was the Changan Lumin, with its highest monthly sales figure since November 2024. Its 15,018-unit total represented a 70.5% year-on-year improvement, while its 2.2% hold of the market was up 0.4pp.

Two models tied for 10th spot, both of which achieved a record result in their fourth month of sales. This was the BYD Sea Lion 05, making its top 10 debut, and the BYD Qin L. Both recorded 15,000 deliveries in June, equating to a 2.2% share.

Best-selling PHEV declines

There was a sense of status quo in the top four of the PHEV market after six months of 2025. However, the gaps between each ebbed and flowed thanks to each model’s performance in June.

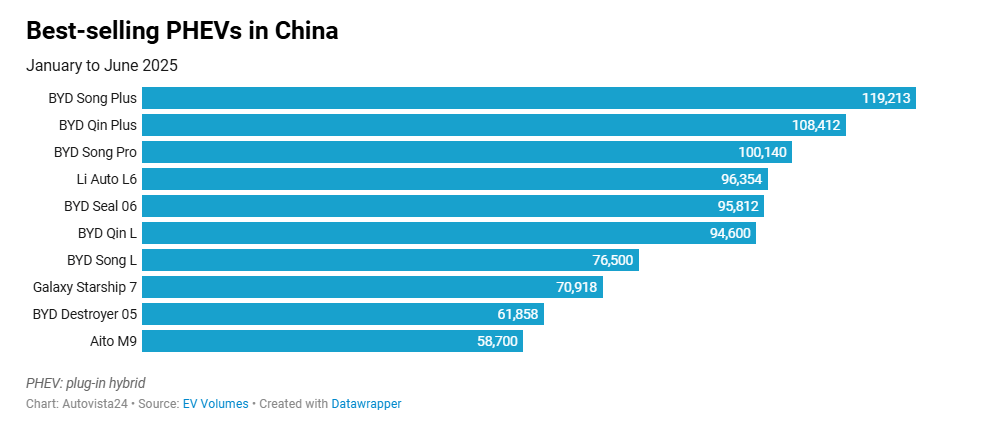

Leading the way after six months was the BYD Song Plus. Despite seeing year-on-year declines in five of the first six months of 2025, its 119,213 total meant it secured first. This translated to a 4.8% market share. However, for the first time since taking the lead in February, its lead over second declined.

Sitting 10,801 units behind in second was the BYD Qin Plus. The model also suffered declines in every month during the first half of 202. However, its volumes were enough to give it a 108,412-unit total. This was enough for a 4.4% market share.

The BYD Song Pro achieved only its second volume improvement of the year in June. This allowed it to hold third six months into the year, although its 100,140 deliveries saw it slip further behind the Qin Plus.

The first non-BYD model in the top 10 between January and June was the Li Auto L6, taking fourth. With 96,354 units, it was 3,786 deliveries behind the top three. However, this was a drop, with the model just 362 units behind in May. Nevertheless, it managed to achieve a 3.9% market share in the six-month period.

The first change in the table occurred in fifth, as the BYD Seal 06 jumped one position. Its strong performance in June left it just 542 units behind the Li Auto L6. The BYD PHEV achieved a total of 95,812 deliveries during the first half.

BYD competes with itself

The rise of the Seal 06 came at the expense of the BYD Qin L, which dropped to sixth. With 94,600 deliveries, it took a 3.8% hold of the market and was 1,212 units behind its stablemate.

Another model making moves was the BYD Song L, which improved to take seventh place. With 76,500 sales, it held a 3.1% market share.

Its rise came at the expense of the Galaxy Starship 7, which dropped to eighth with 70,918 deliveries. This meant it took a 2.9% market share. Having started the year on top, the Starship 7 has not appeared in the last two monthly top 10 standings. This has caused it to drop down the table, although it had maintained seventh position for the three previous months.

The BYD Destroyer 05 re-entered the table in ninth, having dropped out in April. It managed 61,858 sales in the first six months of 2025, equating to a 2.5% share of the PHEV total. Rounding out the top 10 was the Aito M9, with 58,700 deliveries and a 2.4% market share.

Qin Plus moves up

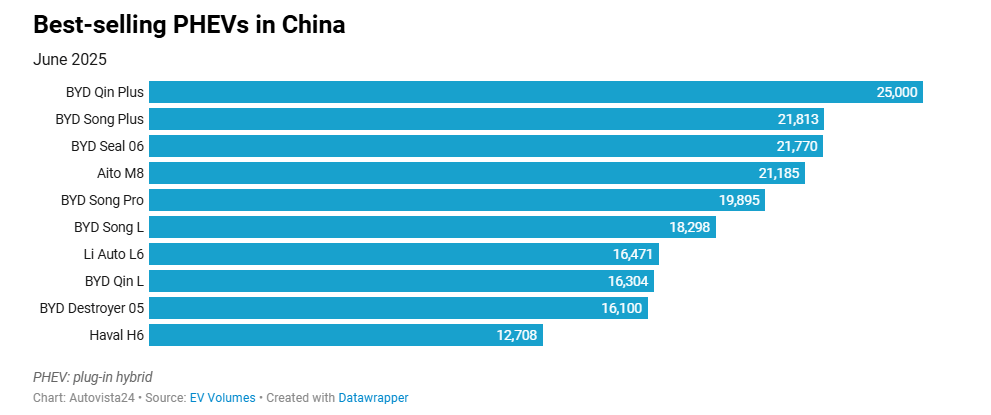

For the first time in 2025, the BYD Qin Plus topped the monthly figures in June. The model achieved 25,000 sales, although this equated to a 29.9% year-on-year drop. The total was enough for a 4.8% market share, which dipped by 4.1pp year on year.

The BYD Song Plus secured second, with 21,813 units taking to Chinese roads in the month. This was a decline of 22.6% year on year. Its hold of the overall monthly PHEV total was 4.2%, down from 7.1%.

Completing BYD’s first top-three lockout since March was the Seal 06. It recorded its best result of the first six months, with 21,770 units delivered. This was a 185.5% year-on-year improvement, while its market share jumped by 2.3pp to 4.2%.

The Aito M8, in only its third month on sale in China, took fourth with 21,815 units. This was a 4.1% hold of the monthly PHEV total. It was the model’s best performance, putting it only 585 units away from the top three.

Fifth went to the BYD Song Pro, with 19,895 sales in June, a 3% improvement over the same month last year. However, with increased competition, the model’s market share fell by 1pp, to 3.8%.

Record results in China

The BYD Song L, which first went on sale in July 2024, was sixth. It achieved 18,298 deliveries in the month, giving it a 3.5% market share.

Following in seventh was the Li Auto L6, with 16,471 sales. This was a decline of 31% year on year, with a 2.8pp fall in market share coming as a result. The model achieved 3.2% of total PHEV deliveries in the month.

Just 167 units back, the BYD Qin L also struggled in June. With 16,304 sales, the PHEV saw a 9.5% drop in deliveries. Its market share declined by 1.4pp, ending the period at 3.1%, as it took eighth place.

A further 204 deliveries behind in ninth was the BYD Destroyer 05. Despite re-entering the year-to-date top 10, it did so due to the poor performances of its competitors. With 16,100 sales, volumes declined 17.2% year on year. This meant its market hold fell from 4.9% in June 2024 to 3.1% this year.

Rounding out the top 10 was the Haval H6, making its top 10 debut with 12,708 units delivered. This was a 584.7% year-on-year improvement.

Despite having launched in September 2022, June was the first time the model achieved a five-digit monthly total. Additionally, the SUV’s June figure was nearly 1,000 units higher than its full-year total in 2024. As a result, its hold of the PHEV total in the month jumped from 0.5% last year to 2.4% in June.

This content is brought to you by Autovista24.

Sulje

Sulje